Volume Profile is a charting tool that displays the amount of trading activity at different price levels over a specific time period, rather than over time as with traditional volume indicators.

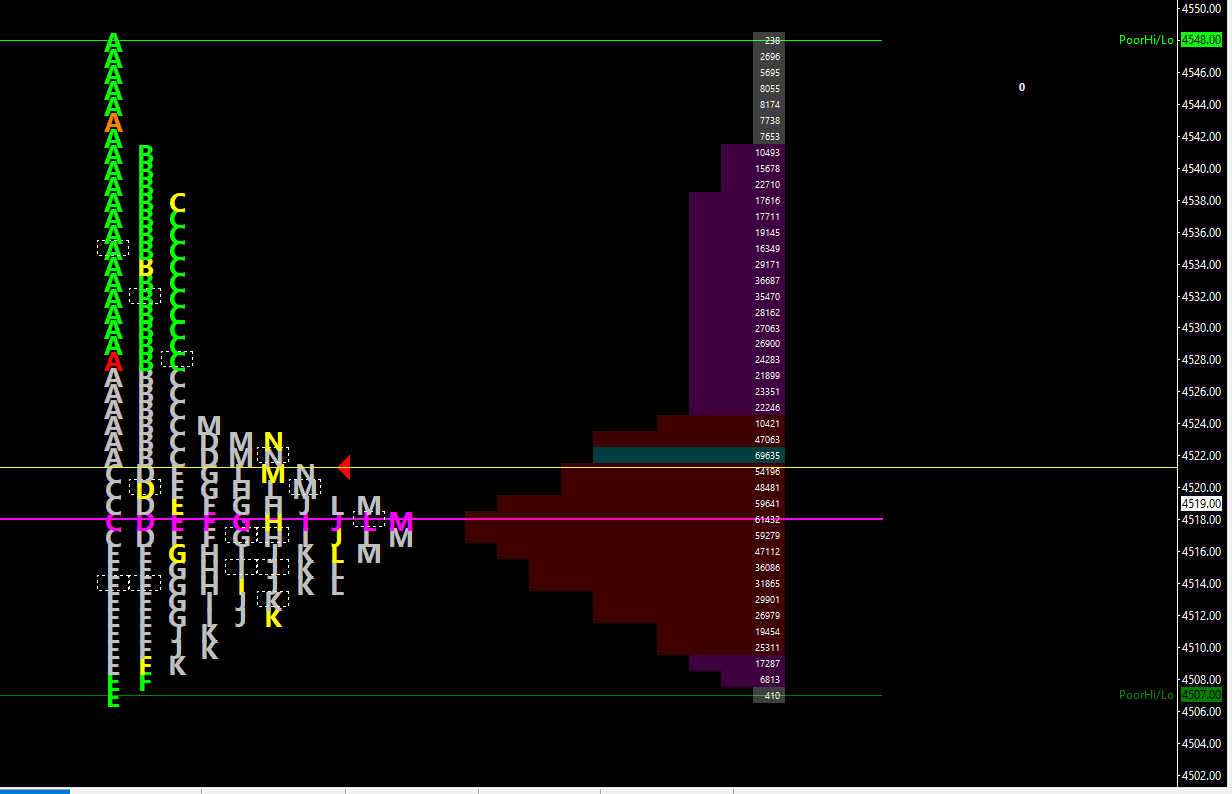

Pictured above with Market profile on the left and volume profile on the right, It’s often used to identify key support and resistance levels, and to understand where the majority of trading activity has occurred. This helps traders gauge market sentiment and make more informed decisions.

Key Components

- Volume Nodes: These are horizontal bars that represent the volume of trades executed at a particular price level. The longer the bar, the higher the volume at that price.

- Value Area: Similar to Market Profile, this is the range where a significant portion of the trading volume has occurred, usually around 70%. It’s considered the “fair value” zone.

- Point of Control (POC): This is the price level with the highest traded volume. It often acts as a strong support or resistance level and is marked by the longest horizontal bar on the Volume Profile.

- Low Volume Nodes: Areas with significantly less trading volume. These are often seen as potential turning points or areas where price can move quickly.

Advantages

- Market Insight: Provides a deeper understanding of market structure and the levels at which traders find value.

- Trade Confirmation: Can be used to confirm other technical signals, adding an extra layer of validation to your trading decisions.

- Risk Management: Helps in setting more accurate stop-loss and take-profit levels by identifying key support and resistance zones.

- Multiple Timeframes: Can be used on various timeframes, from intraday to long-term charts, making it versatile for different trading styles.

Limitations

- Learning Curve: Understanding Volume Profile and how to interpret it effectively can take time, especially for beginners.

- Data Requirements: Accurate Volume Profile analysis requires high-quality, tick-by-tick data, which may not be available for free.

- Not Foolproof: Like any trading tool, it’s not 100% accurate and should be used in conjunction with other methods of analysis.

Volume Profile is a valuable tool for traders looking to understand market dynamics beyond just price action. It’s popular among day traders and those involved in futures and forex markets, but it can be applied to virtually any financial market.