Volume Candles

Volume candles, also known as “volume bars” or “volume candlestick charts,” combine elements of traditional candlestick charts with volume data to provide a more comprehensive view of market activity. Unlike standard candlestick charts that only display price information (open, high, low, close), volume candles incorporate the volume traded during a specific time period into the candle’s structure.

The width of the candle represents the volume of trading activity during that time period. A wider candle suggests higher volume, while a narrower candle indicates lower volume.

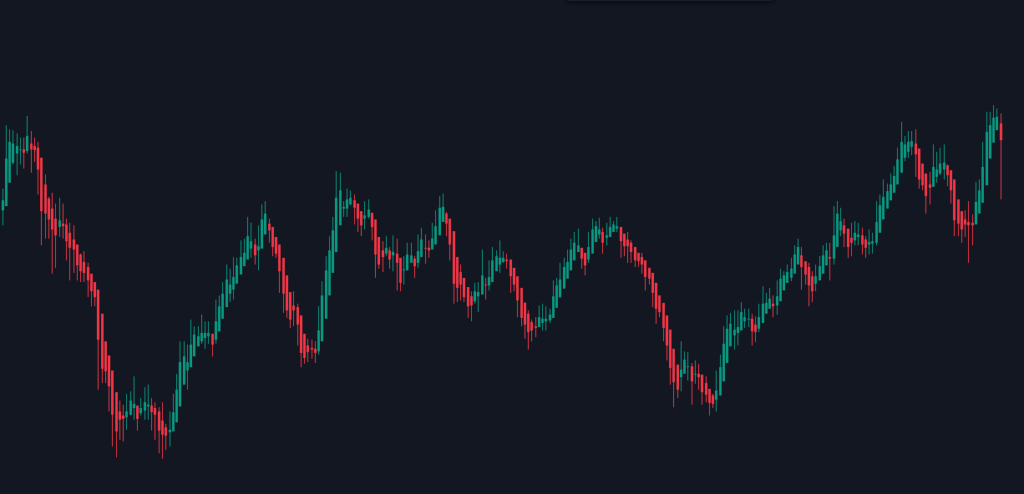

Heiken Ashi Candles

Heiken Ashi candles are a type of candlestick chart that aims to filter out market noise and better represent the trend of an asset. The term “Heiken Ashi” comes from Japanese, where “Heiken” means “average” and “Ashi” means “pace.” Unlike traditional candlesticks, which use the open, high, low, and close prices for a given time period, Heiken Ashi candles use average prices to smooth out fluctuations.

Similar to traditional candlesticks, Heiken Ashi candles are color-coded to indicate upward or downward movement. However, the colors tend to stay consistent for longer periods, making it easier to identify trends.

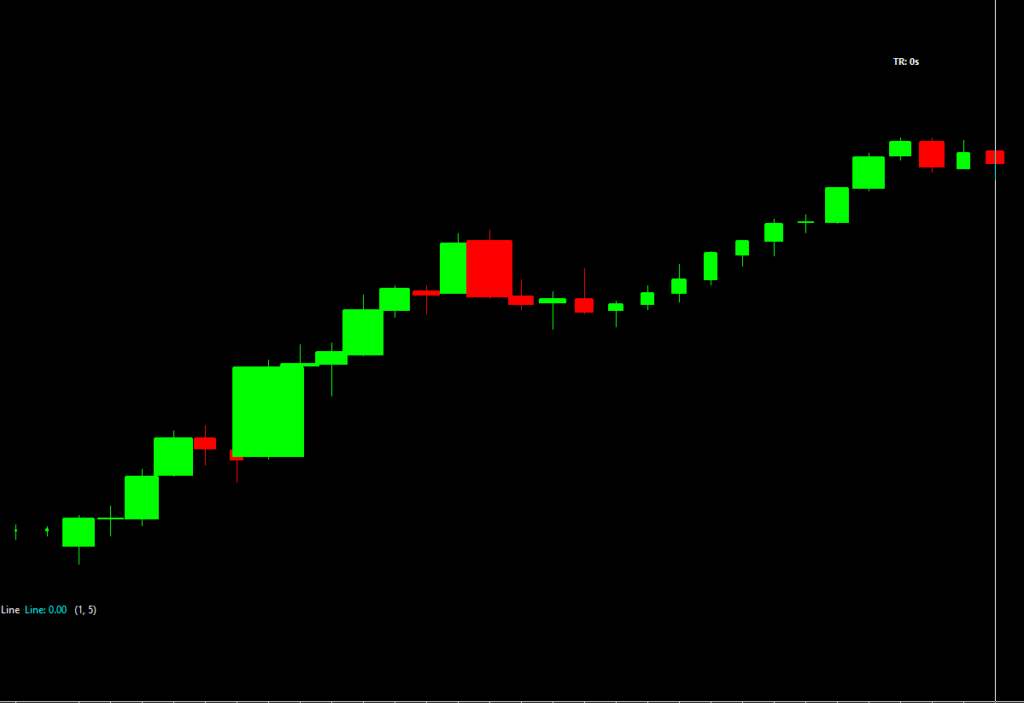

Renko Bricks

Renko bricks, or simply “Renko,” are a type of charting technique used to illustrate price movements. The term “Renko” comes from the Japanese word “Renga,” which means “brick.” Unlike traditional candlestick charts that display price based on time intervals (like 1-minute, 5-minute, or daily), Renko charts focus solely on price movement.

Renko bricks are directional. An upward (usually green or white) brick is drawn when the price moves up by the predetermined amount, and a downward (usually red or black) brick is drawn when the price moves down by the same amount.

Renko charts are particularly popular among forex traders but can be applied to any market, including stocks and commodities. They are often used in combination with other forms of analysis to create a comprehensive trading strategy.